Renewable natural gas (RNG) is rapidly shifting from niche fuel to mainstream drop-in substitute for natural gas. The pace of new announcements by governments and gas utilities is accelerating, signaling the emergence of biomethane as essential in driving decarbonization of the natural gas grid and transportation, two large and difficult-to-decarbonize sectors of the global energy system.

RNG Market Drivers

Responding to end-user demand for lower carbon and renewable fuels

Gas utilities around the world face increased demand from residential, commercial and industrial customers who want to reduce their carbon footprint and meet personal and corporate sustainability goals.

Greening the global gas distribution network

Greening the global gas distribution network

In many countries, the natural gas grid is significantly larger than the electricity grid in energy delivered (1.2 times larger in the US, 2 times in Canada, and 4 times in the UK). Renewable technologies like wind and solar have seen rapid growth to green the electricity grid and reduce reliance on fossil fuels; the same is possible for the gas grid when we substitute fossil natural gas with RNG.

Mitigating the threat of electrification

Mitigating the threat of electrification

Electricity utilities have long offered greener electricity options through renewables such as hydro, wind and solar. Gas utility customers looking for low-carbon sources of energy are threatening to switch to electricity. With collectively trillions of dollars of gas distribution assets in the ground at risk of becoming redundant, more and more gas utilities are implementing a renewable pathway through RNG.

Delivering a zero-emission-fuel alternative for natural gas vehicles

Delivering a zero-emission-fuel alternative for natural gas vehicles

The use of natural gas in heavy-duty truck and marine transportation has increased significantly in recent years to address air quality and greenhouse gas emissions concerns. Switching from diesel to natural gas is good, but switching from diesel to RNG is game changing. RNG provides an immediate and compelling truly sustainable transport solution, particularly in these sectors where electrification options are not available or viable.

Meeting regulatory demands

Meeting regulatory demands

Climate change concerns at societal and political levels have driven many countries to introduce regulatory regimes on carbon emissions across a wide variety of sectors, creating opportunity for market participants that offer low-carbon solutions.

Mechanisms Supporting Market Growth

In Greenlane’s primary markets in North America and Europe, government targets, policies, and funding mechanisms are supporting market growth.

Canada

- April 2018: British Columbia regulation for 5% RNG by 2022

- December 2018: plan for 15% by 2030

- March 2019: Quebec adopts regulation requiring 1% RNG in gas network by 2020, 5% by 2025

USA

- Federal Renewable Fuel Standard (RFS) and California and Oregon State Low Carbon Fuel Standards driving uptake of RNG in transportation (i.e. RINs and LCFS credit markets)

- March 2019: SoCalGas announces commitment to 5% RNG in their gas network by 2022, 20% by 2030

- July 2019: Oregon signs bill targeting 15% RNG into state’s pipeline system by 2030, 30% by 2050

France

- November 2018: ENGIE announces €800M in next five years in support of 10% RNG in gas network by 2030, aligned with French Energy Transition Law for Green Growth

Italy

- March 2018: European Commission approves €4.7B public support scheme for advanced biomethane and biofuels

Denmark

- February 2019: Reaches 11% RNG in 2018 (near zero in 2014). Projects 100% RNG by 2035

Enormous Market Growth Potential

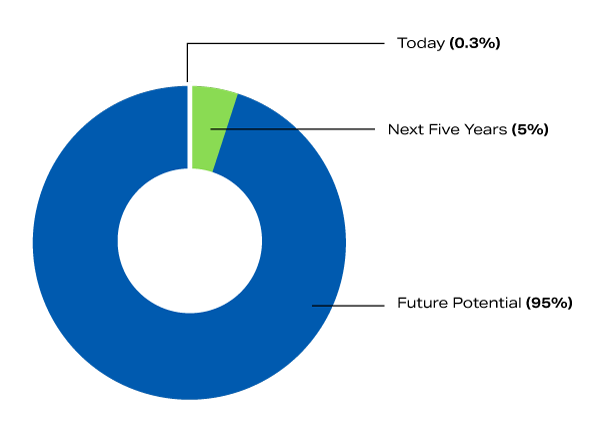

RNG Share in the North American Natural Gas Distribution Network

The current penetration of RNG in the North American natural gas distribution network is approximately 0.3%. Industry forecasts predict significant market growth over the next five years for renewable natural gas and biogas upgrading technologies in North America and Europe. To reach a conservative estimate of 5% RNG content in the North American natural gas distribution network in the same timeframe represents a market opportunity of approximately US$18 billion in new biogas upgrading equipment sales and US$27 billion in annual RNG sales.